*Disclaimer: This is not investment advice.

This is meant to be a quick idea, but I’ve thrown detailed notes below for those who are new to the story/ curious to know more.

What you need to know

Logitech (LOGI 0.00%↑) is a cyclical electronics accessories business being valued as a secular grower with structurally improved margin. Growth hinges on a cycle rebound story to drive organic growth. In my view, LOGI’s organic growth algorithm is unsustainable while the cycle is unlikely to rebound. Instead, growth comes from aggressively booking revenues on the sell-in. True earnings will manifest when inventory is sold-through to the consumer, and LOGI will face margin compression via inventory write downs near F2H’25.

FY’25 guided Non-GAAP EBIT margin is 16%, while I’m at 13% (14% EBITDA). LOGI also guides LSD growth. At the low end of that growth guide, and 14% EBITDA, I get $632m EBITDA. If we assume 13x NTM EBITDA (slightly above 24-yr normal to account for slight normal margin improvement), I get to a $62.60 stock by year end or -27% from here including dividend.

Logitech will discount to clear retail channel inventory starting F3Q’25, presenting a tactical short opportunity. Risk/ reward is subjective on conviction here (not necessarily a no-brainer), but I recommend sizing in small and doubling down if share price breaks $93.00.

Model Sum

R/R Cases

Cap Table and Trading Stats

Deep(er) Dive

Company Overview

Logitech sells mice, keyboards, webcams etc to consumer and enterprise customers. The company was founded in Switzerland in 1981. It has grown to be the world’s largest and most well known peripherals brand. Most video conferencing webcams are also Logitech branded (the ones that follow you around and zoom in). This is all to say that Logitech does possess brand equity, and I don’t think it’s a terminal short.

However, peripherals is not a quality business. Like most hardware, demand follows refresh/upgrade cycles every 3-4 years. The graph below is a good visualization of the cyclicality.

COVID stimulus spending pulled forward the refresh cycle, and we are now in a downcycle. This is a key reason why investors are bidding up Logi’s growth as it signals the cycle is rebounding.

Sell-in vs Sell-through

The company sells 97% of product through retailers like Best Buy, Amazon, TD Synnex, etc. So, it’s important to understand sell-in vs sell-through accounting dynamics (like a consumer cyclical).

Sell-in means selling to the retailer and filling the retail channel/ shelf

Sell-through means the retailer sells to the customer

Sell-in is when Logi books revenues/ COGS

If Sell-in pricing is high, but Sell-through pricing is low, inventory will be written down and gross margin will be pressured.

Setup

Last year, Logitech was a gross margin momentum story. The company was able to take market share and raise prices, all while taking down inventory. Freight rates were also a cost tailwind. Yes they improved manufacturing costs, but of the 340bps of gross margin expansion, only ~140 was structural vs 200bps variable/one-time.

“So we had about 200 basis points of benefit year-over-year on product costs… that should be durable and should translate into future quarters as well. 200 basis points year-over-year was logistics, ocean, air, freight.” – FQ3’24 commentary

My conversations with IR also noted that “last year’s ~200bps margin expansion from inventory reduction and freight rates is under pressure”.

This year, management is guiding to a cycle rebound whilst maintainingabove normal margins.

And, it looks like the market is buying the guide:

Reverse DCF also shows the market bakes in the guide. The bull case (scenario 1) is slightly above near term and long term targets. Today’s price backs roughly into the mid to high end of guidance.

Investors are willing to capitalize Logitech’s overearning in the hopes of a cycle rebound.

The Market Buys The Guide, but I Don’t

LOGI’s target is 1% - 3% y/y organic growth on 16% non-GAAP operating income. For the guide to be true, we have to believe that the peripherals cycle rebounds and Logitech sustains above normal margin. Both are unlikely to be true.

Deconstructing the Margin Gain

It was easy to take down inventory in a down cycle, and because COGS bake in allowances for write downs, inventory reduction increases gross margin. Freight rates also normalized post-COVID supply shock. From both freight rates and inventory, Logitech booked 200bps of one-time margin expansion.

Variable/ 1-Time Cost Benefits are Reversing

Inventory and freight rates are coming back up:

That 200bps of variable margin expansion will reverse.

Logitech has a Broken Growth Algo

Growth has been propped up by pricing. For the 1% - 3% guide to make sense, we need demand and pricing power to kick in.

Demand Will Not Rebound

Management’s 1% - 3% y/y sales growth guidance bakes in demand tailwinds from the AI PC cycle rebound.

The story is that the PC cycle will rebound with the new NPU chip1 (the chip allows for LLMs to be run on the edge). Bulls think, “if someone buys an AI PC, they’ll probably refresh their mouse too”. They also point to a 50% correlation between Logitech peripherals and PC volumes as a proxy for attach rate.

The attach rate thesis is sell-side noise. AI PC demand has been mentioned by a sell-side analyst on each quarterly call and conference for the last 5 quarters.

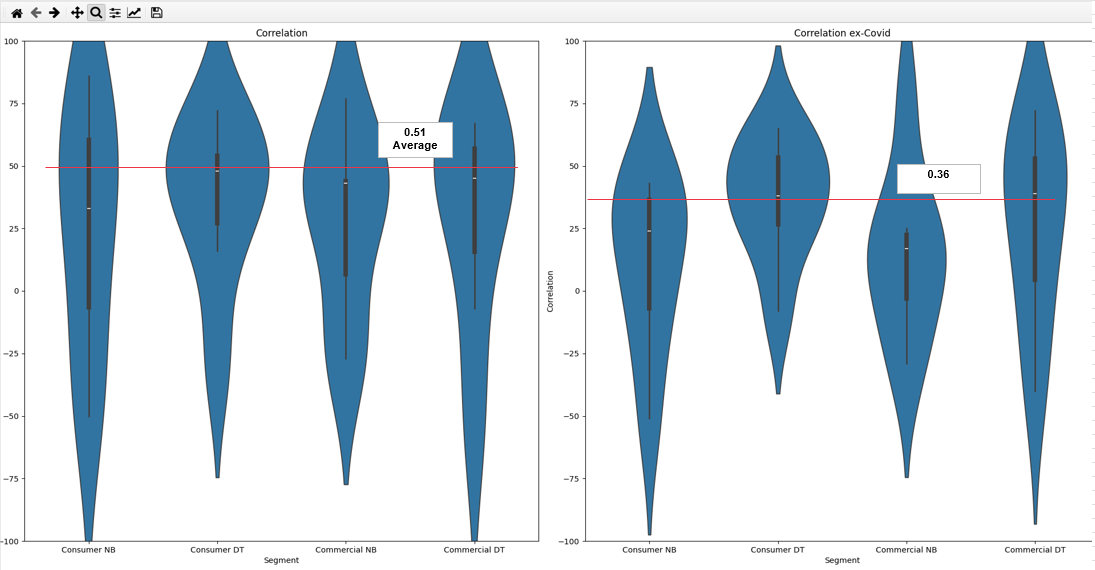

The attach rate is far worse than bulls believe. The true attach rate is obfuscated by COVID stimulus spend. Below is correlation between Logitech’s 10 year volume and PC market 10 year volumes (market volume via UBS sell-side note). I’ve broken out COVID and ex-COVID.

Ex-COVID, correlation drops to 0.36.

What investors/ the sell side are getting wrong is that volume correlation is attributed to macro and not product. And, by the way, this is assuming AI PC demand is even real to begin with. Though I believe there is some attach between PC and peripherals, at LOGI’s current share price, we have to believe meaningful attach, which is unlikely.

Without AI PC driving demand, secular end market growth is not strong enough to prop up volume. The 3 highest growth verticals are 1) video collaboration, 2) gaming, and 3) mouse & keyboard. Secular demand in video collaboration (enterprise webcams) is struggling as IT Budgets are all going to AI. Gamer headcount growth, base rate for gaming revenue growth, continues to slow2. Mice and keyboards demand exploded in COVID and is still normalizing down.

Net, demand is unlikely rebound.

Pricing is Unlikely to Grow MSD

Like I said above, if volumes can’t come back, pricing needs to be MSD y/y. MSD is unlikely at best. The only reason LOGI even maintained flat pricing last year was because they took share in an uncompetitive/ low demand market. Competition was also temporarily eased as Microsoft exited the space.3

The competitive environment is now heating up as other players try to capture any residual PC cycle demand. We see evidence of this on camelcamelcamel.com, where pricing for LOGI4, Razer5, HyperX6 etc are all falling as they discount to drive growth (just look on the site). Please let me know in the comments if there is an API/ easy way to scrape CCC.

Setup for Latent Margin Compression

The key variant view is that I believe Logitech’s true margin is being obfuscated. As previously mentioned, Logitech operates on sell-in/ sell-out accounting dynamics. To refresh, here is an excerpt from my 1 on 1 with IR:

"I book revenues and COGS on the sell-in… If Best Buy or so has to take down their ASP below the cost basis, we write down inventory”

Similarly, Best Buy’s merch org rep told me this:

Finally, from the 10k:

“If there is an abrupt and substantial decline in demand for Logitech's products or an unanticipated change in technological or customer requirements, we may be required to record additional write-downs that could adversely affect gross margins in the period when the write-downs are recorded."

Simply, if Logitech sells a product to Best Buy in Q3 for 43% gross margin, it will report 43% gross margins on its Q3 income statement (sell-in). But, if Best Buy struggles to sell that same product in Q4, Logitech would book a write down as COGS in Q4 (sell-through).

So, what matters here is how Logitech manages its retail channel inventory. As retail channel inventory balloons, LOGI increases its risk of write down.

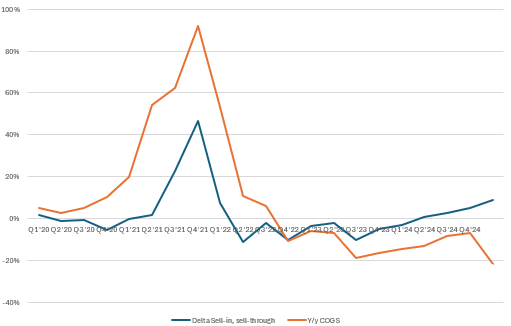

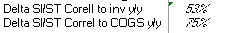

We can use the delta between the y/y growth in sell-in and sell-through revenue as a proxy for channel inventory. If sell-in is higher than sell-through (delta), there is channel inventory build up.

As you can see below, the fundamental relationship holds.

This past quarter, the relationship broke. This is temporary and the two lines will mean revert.

COGS decreased as LOGI took down more own inventory. The delta sell-in/ sell-through accelerated. What this looks like is LOGI cycling owned inventory into channel inventory. Thus, they’re able to aggressively book higher margins today while leaving more inventory at risk of being written down tomorrow.

As previously mentioned, demand won’t come back, so it’s not strategic for LOGI to be flooding supply. On top of temporary margin drivers reversing, LOGI is at further risk of write-downs.

I model gross margin compression starting in FQ3’25. Management is stuffing channels to front run the holiday season, but can’t sell without significant discounting.

On Corporate Governance

Here I propose a theory, but take it with a grain of salt. Management could be trying to aggressively book numbers in response to backlash of the board

On Aug 5, 2024, Daniel Borel (co-founder of Logitech) issued an open letter attempting to oust current chairperson of the board Wendy Becker. His argument is that Becker is not a technologist and has made execution missteps while managing Logitech. She also hired new CEO Haneke Faber who similarly has no technology background. With the turmoil, Becker must prove to shareholders that Borel is wrong. This struggle has been ongoing for the past FY.

On Sep 4, 2024 Wendy Becker was announced at the Annual General Meeting to be reelected to be chair person of the board. The stock slid 4% - the market shares Borel’s concerns.

With this scrutiny, Becker and Faber want to prove to the market that they don’t need tech expertise to successfully run Logitech. It’s possible this is driving them to aggressively book/ target growth on unrealistic margins.

Valuation

If Logitech faces margin compression in 2H’25 while being unable to drive LSD growth, I get to 632M Non-GAAP EBITDA. Ex-growth + margin compression means the multiple will be cut. Last 24-year median NTM EBITDA multiple is 12x. I give Logitech 1x multiple expansion from cost and brand improvements. Thus, at 13x 632M Non-GAAP EBITDA, I get to $62.60 at a base case.

The current multiple bakes in perfect execution, so even if Logitech beats the guide, the stock only has ~16% upside.

Risks

At current valuations, shorting Logitech is de-risked. Q1 results were great and the stock still did not move. SI has been increasing since June, but I think the steep part of the yield curve is still yet to come.

The obvious risk is that Logitech has improved their inventory management and now has a structural cost advantage. However, this is unlikely scenario is already baked into the stock.

Catalyst

I’m playing this short for F2H’25 when Logitech has to discount shelf inventory to drive sell-through. Logitech is not a business in terminal decline, so we have to be tactical around timing. If I’m right, I believe that margin compression peaks 1Q’26 which is when I would exit the short. I personally would also exit if R/r drops below 1.5x.

https://support.microsoft.com/en-us/windows/all-about-neural-processing-units-npus-e77a5637-7705-4915-96c8-0c6a975f9db4

https://explodingtopics.com/blog/number-of-gamers

https://www.theverge.com/2024/1/5/24026323/microsoft-incase-partnership-keyboards-accessories-partnership

https://camelcamelcamel.com/search?sq=logitech

https://camelcamelcamel.com/search?sq=razer

https://camelcamelcamel.com/search?sq=hyperx

Really good stuff

Interesting read!